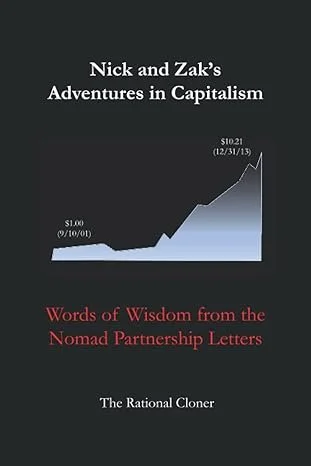

Nick and Zak’s Adventures in Capitalism

Nick and Zak’s Adventures in Capitalism could easily be described as a memoir in discipline, conviction, patience, and an almost zen-like comfort with inactivity. That last part may need a little explanation unless you’re already familiar with Nick and Zak’s investing philosophy.

As long-term investors, they excel at something that runs counter to most people’s natural instincts; the ability to do nothing. If their investment thesis is working, they simply let it run, resisting the temptation to “tinker” for the sake of appearing active. They’re the living embodiment of the White Rabbit’s famous inversion

“Don’t just do something, stand there!”

The book is exactly what it promises, a collection of annual letters from the Nomad Partnership. But nestled within those letters are timeless principles of successful investing. At times, the repetition of “little has changed” might seem redundant, but that’s part of the point. True investing success doesn’t come from constant activity but instead from patience, understanding, and allowing compounding to do its work.

Across their letters, Nick and Zak share insights on topics like portfolio concentration, growth versus value investing, and the importance of delayed gratification. They also include case studies of specific companies that Nomad has invested in, providing practical examples of how their philosophy plays out in the real world.

The structure lends itself to flexibility in that you can read it cover to cover, dip into individual letters, or return to it periodically for a refresher. While sequential reading provides the clearest sense of progression, you won’t lose much by jumping between sections.

I was first introduced to Nick and Zak through William Green’s Richer, Wiser, Happier, but their own story is quietly fascinating. This is a book that feels both calming and enlightening, making for a perfect holiday read for anyone who likes their poolside material to carry a bit of intellectual weight. If you take even a fraction of the lessons here and apply them to your own investing, the return on that modest outlay I suspect will come many times over.

Who’s it for?

This book is best suited to readers with an existing interest in investing, those who already understand the fundamentals and want to refine their thinking around long-term strategy. It’s less a beginner’s manual and more a guide for those ready to embrace patience, focus, and the discipline of doing less, better. For investors who value thoughtful insight over adrenaline, this is a gem.